Medtronic – Dividend Growth Stock

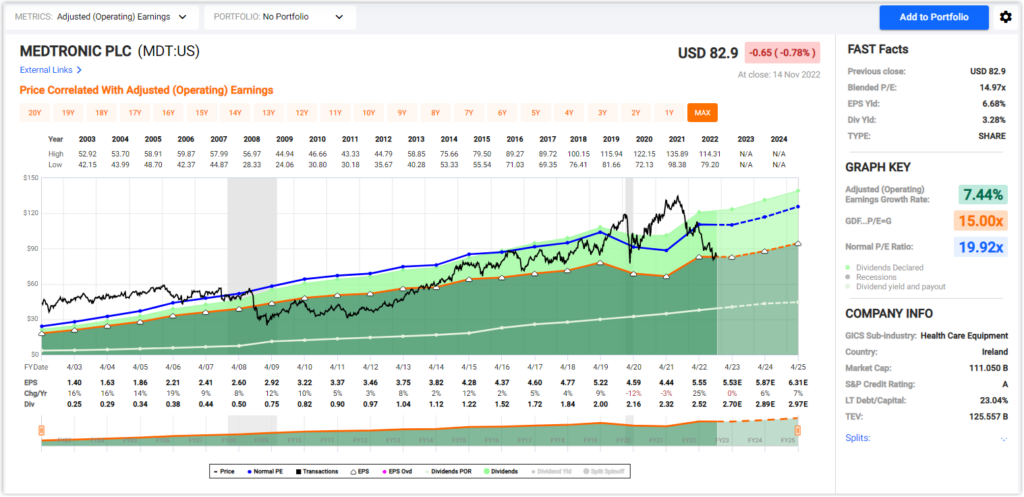

Medtronic PLC (MDT) is one of the premier “Big 4” medical device stocks. This high-quality blue-chip dividend growth stock has increased its dividend for 45 consecutive years with no end in sight. Mr. Market normally prices this blue-chip at a premium valuation. However, Medtronic, which started out significantly overvalued in 2022, has recently moved into fair value territory. Consequently, this is a rare opportunity to invest in this A rated dividend growth stock with low debt to capture a dividend yield that is currently over 3%.

In this video, I cover the basic fundamental valuation modalities which indicate a research candidate worthy of conducting a more comprehensive research effort. Additionally, I will illustrate how easy it is to conduct that research effort when you have the proper research tools at your disposal. In short, FAST Graphs make it easier and faster to research a stock than ever before.

FAST Graph Analyze Out Loud Video on Medtronic

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long MDT

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.