Authors: James Long and Chuck Carnevale

Summary

- MPW’s dividend is safe. It is in the hospital business, a mission-critical industry where hospital bankruptcies happen but infrequently compared to other industries.

- MPW has rent escalators built into the contracts, and rent revision happens at the start of every year so shareholders can expect greater rental collection revenue from 2023.

- MPW can comfortably pay dividends at the 2022 rate even if 50% of Steward’s hospitals get into trouble and are unable to pay 50% of the rent.

- MPW is so undervalued right now that the downside exposure is limited, while the upside is far greater, thanks to management’s efforts to address concerns by reducing exposure to Steward.

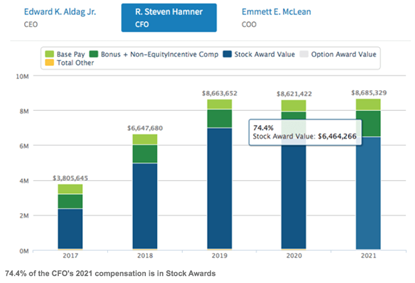

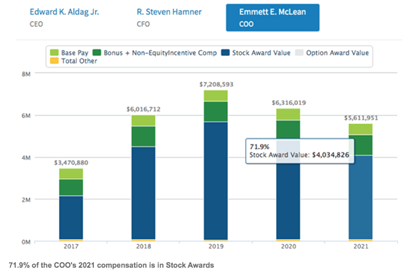

- Trust MPW’s management to do right by shareholders because its self-interest is highly aligned with shareholders and the betterment of the company. If they wish to profit from their stock award, MPW has to do well.

Preamble

Now, much ink has been spilled over Medical Properties Trust (MPW) since 2021. The average of 2 articles per month between January 2021 to January 2022 increased more than 3x to an average of 7 articles per month between February 2022 to 17 February 2023. It will be an understatement to say that investors both long and short this stock are interested in it.

In this article, we shall examine the investment thesis of Medical Properties Trust from the point of view of an Income Investor. We will examine the possible thesis-breaking arguments that threaten the dividend, study the FFO forecasts done by analysts who follow Medical Properties Trust , establish if these forecasts may hold up (or not) in different scenarios, and examine management’s stewardship of Medical Properties Trust before coming to our valuation and conclusion.

Overview of Investment Thesis

Mission-Critical Nature of the Business

According to the 2021 10K (pages 30 and 31) on the revenue sources and business model,

“Our revenue is derived from rents we earn pursuant to the lease agreements with our tenants, from interest income from loans to our tenants and other facility owners, and from profits or equity interests in certain of our tenants’ operations. Our tenants operate in the healthcare industry, generally providing medical, surgical, rehabilitative, and behavioral health care to patients.

We are a self-advised REIT focused on investing in and owning net-leased healthcare facilities across the U.S. and selectively in foreign jurisdictions. We acquire and develop healthcare facilities and lease the facilities to healthcare operating companies under long-term net leases, which require the tenant to bear most of the costs associated with the property. We also make mortgage loans to healthcare operators collateralized by their real estate assets.

From time-to-time, we may make noncontrolling investments in our tenants, typically in conjunction with larger real estate transactions with the tenant, that give us a right to share in such tenant’s profits and losses and provide for certain minority rights and protections.

Our business model facilitates acquisitions and recapitalizations, and allows operators of healthcare facilities to unlock the value of their real estate assets to fund facility improvements, technology upgrades, and other investments in operations.

At September 30, 2022, our portfolio consisted of 437 properties leased or loaned to 55 operators, of which six are under development and four are in the form of mortgage loans. We manage our business as a single business segment.“

Medical Property Trust (MPW) manages hospitals, and the nature of hospitals, unlike other REITs like shopping malls or industrial, is that they are a critical part of any community.

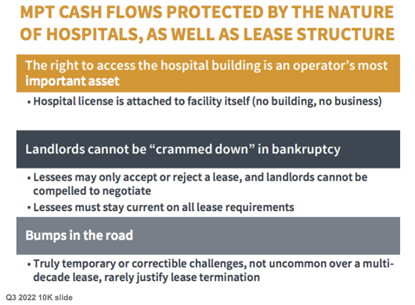

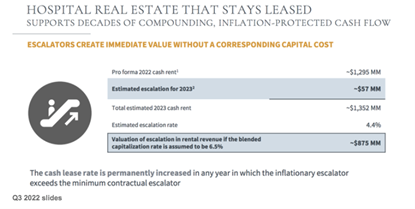

In the slide above, management took pains to illustrate the resilient nature of MPW’s rental cash flow. In addition, in the slide below, MPW reminded investors of two important facts about its business model:

1. There are automatic rent escalators built into the contracts, and rents go up every January, and

2. The cash lease rate, the cost to occupy the space commonly stated as a dollar amount per square foot of space per year, will be permanently increased “in any year in which the inflationary escalator exceeds the minimum contractual escalator”.

In other words, the inflationary environment gives the rental cash flow a permanent boost.

But… Steward?

Let’s address this elephant in the room. And since skeptical readers/investors are unlikely to be convinced by profitability assurances from MPW’s management alone, we shall examine the business continuity case for Steward’s managed hospitals from a different angle.

Income Investors are worried that MPW may cut its dividends due to issues with the hospital operator Steward. After all, hospitals can go bankrupt, or at least they can file for bankruptcy.

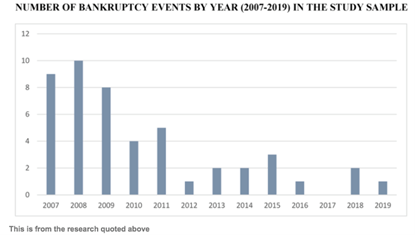

According to this research, between 2007 and 2019, 48 hospitals and healthcare systems filed for bankruptcy protection, and half of these ceased operations. There were external factors that led to the demise of the 24 hospitals and healthcare systems. Most of these bankruptcy cases were filed during the period of the Great Financial Crisis (see graphic below).

An observation is there were not many cases that happen in any given year, except during the worst of the Great Financial Crisis. The Covid years of 2020-2022 are arguably worse than that during the Great Financial Crisis, and although many rural hospitals closed, the numbers are not as drastic as one might imagine.

Our discussion focuses on rural hospitals because they are most likely to be hit the hardest during Covid. Already, in the period after the Great Financial Crisis, hospitals and other provider organizations have been asked to do more with less while undergoing sweeping changes and mandate capital investments associated with the implementation of electronic health records, increasing cybersecurity threats, and complex quality reporting requirements. Matters definitely got even worse for hospitals and their operators during the pandemic, when profitable elective surgeries have to be suspended and extra beds had to be set aside for covid-related cases. These onerous requirements and changes are especially burdensome on rural hospitals serving a much smaller community.

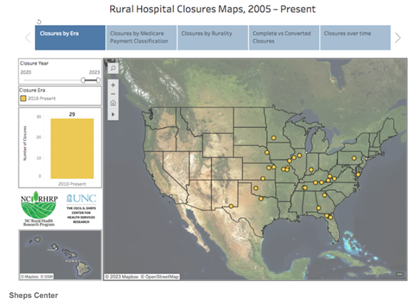

According to this dynamic data from Sheps Center of the University of North Carolina at Chapel Hill, 29 rural hospitals closed between 2020 to the present date. This is certainly unfortunate but it is not a sky-is-falling scenario.

Here, we will bring your attention back to one of the sources of cash flow for MPW, which comes “from interest income from loans to our tenants and other facility owners“. Preventing hospitals from going bankrupt is an important role that MPW does through its loans to its hospital operators (like Steward) in order to allow the hospitals under their management to continue to function, provide acute care for the communities they serve, and to provide jobs for the people living in those communities. Due to the many fears uncertainty and doubt (FUD) cast by the short reports, investors may have increased doubts about the management’s underwriting acumen or their business dealings. However, there is nothing nefarious about MPW making loans to its hospital operators to keep them afloat to keep paying their rent, and to keep patient-care and well-being front and center.

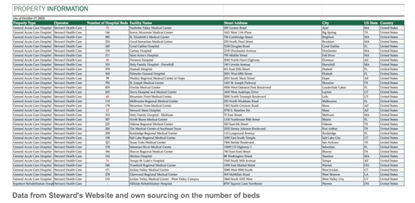

Next, let’s see how many of Steward’s portfolio of hospitals fall under this vulnerable “rural hospital” classification. If the number is a huge one, that would give genuine cause for concern, since these hospitals are at greater risk of closure, and they earn less than their urban counterparts.

Rural hospitals, as defined by National Center for Biotechnology Information (NCBI), are much smaller – less than one-third the size of urban hospitals in average bed size (76 beds to 252 beds per hospital), and total charges per discharge in rural hospitals are only slightly more than half (56%) of total charges in urban hospitals ($3007 versus $5367).

Going by other more general definitions, however, rural hospitals are simply “small” meaning under 100 beds in size. With that, let’s take a look what the kind of hospitals managed by Steward to see the likelihood of them running into issues.

There are 36 hospitals and medical centers in the US (and 2 in Malta) managed by Steward Heath Care. 34 of these are acute (i.e. short-term) care hospitals. 5 of these hospitals have fewer than 100 beds, or just a 14.7% higher risk of Steward’s portfolio facing issues.

In other words, the vast majority of the hospitals managed by Steward are medium to large in size and are found in urban settings serving a greater population and hence more revenue opportunities and lower chances of going bankrupt.

Let’s be more conservative and change the definition of “small”, doubling it from 100 to 200, and that will mean 47% (16 of the 34) of the Steward managed hospitals may face greater financial duress.

So, can MPW afford to keep paying dividends?

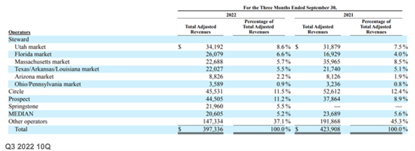

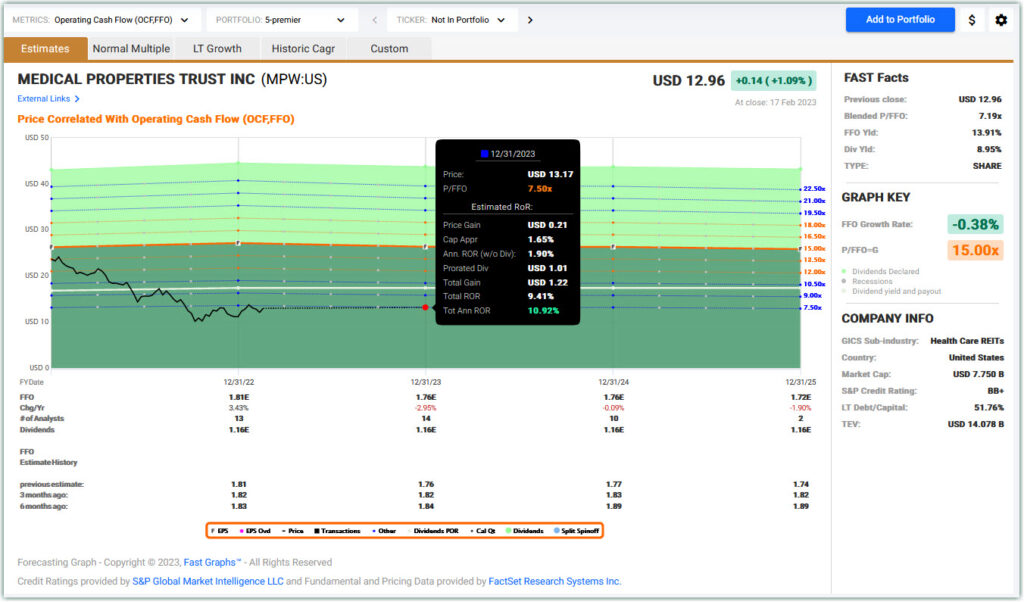

Medical Properties Trust guided for the full-year normalized FFO within the range of $1.80-1.82. FactSet analysts are modeling a normalized FFO of $1.81 in 2022, and a reduced normalized FFO of $1.76 for FY 2023. The company paid out $1.16 per share in dividends in FY 2022. With the declaration of $0.29 per share in dividends for Q1 2023, the company is signaling that it intends to (1) keep paying dividends but (2) pause the growth in dividends. Nevertheless, time will tell whether they freeze or continue growing their dividends. This is something the income investor needs to be aware of.

Scenario 1: The Situation Plays Out As Forecast with $1.76/share in FFO and $1.16/share in dividends to be paid out in FY 2023, and there is no reduction in rent collection, and all of Steward’s hospitals continue to function and pay rent on time

In this scenario, the dividend will be well covered at the same rate. And if the situation improves and MPW decides to raise dividends (e.g. by 10% to $1.28/share), MPW FFO of $1.76/share can still cover that increase.

Scenario 2: After the acquisition of the entire $1.2 billion Utah hospital portfolio currently operated by Steward Health Care System to CommonSpirit Health, Steward’s concentration in MPW’s portfolio will fall by 6% to 24%. If 50% of Steward’s “rural hospitals” get in trouble and rental collection from Steward falls correspondingly by 50%, that will represent a 12% haircut in the rental collection.

In this scenario, the originally expected FFO of $1.76 will fall by 12% to $1.55. This reduced FFO is still enough to cover a dividend rate of $1.16/share.

Wait… what if MPW gets a rating downgrade? Can MPW still afford to pay dividends?

On 22 December 2022, S&P Global Ratings placed MPW on CreditWatch with negative implications due to its increased exposure to the pressured tenant Steward Health Care.

This is big.

For MPW to grow, it has to acquire and develop real estate primarily for long-term lease to providers of healthcare services, such as operators of general acute care hospitals, behavioral health facilities, inpatient physical rehabilitation facilities, long-term acute care hospitals, and freestanding ER/urgent care facilities.

To do so, the company has to depend on its credit line. At the current price of $12-$13, I doubt management will elect to sell shares to raise capital to do so.

On June 29, 2022, MPW amended its Credit Facility to extend the maturity date of its revolving facility to 30 June 2026 with an option to extend for an additional 12 months. What is critical is this part in the Q3 2022 10Q:

“The applicable margin for term loans that are ABR Loans is adjustable on a sliding scale from 0.00% to 0.70% based on current credit rating. The applicable margin for term loans that are Term Benchmark Loans is adjustable on a sliding scale from 0.875% to 1.70% based on current credit rating. The applicable margin for revolving loans that are ABR Loans is adjustable on a sliding scale from 0.00% to 0.50% based on current credit rating. The applicable margin for revolving loans that are Term Benchmark Loans or RFR Loans is adjustable on a sliding scale from 0.80% to 1.50% based on current credit rating. The facility fee is adjustable on a sliding scale from 0.125% to 0.30% (currently 0.25%) based on current credit rating and is payable on the revolving loan facility.“

If MPW’s credit rating were to fall further from the current BB+, this will increase its interest repayments and hampers its ability to “acquire and develop real estate”, to “make noncontrolling investments in its tenants that give MPW a right to share in the tenant’s profits and losses and provide for certain minority rights and protections”.

Thankfully, Improvements Are In Sight

The first important improvement to the situation is that Steward Health Care System completed the extension of its ABL agreement with its lenders (asset-based loan), through December 2023, alleviating the primary concern of the rating agency.

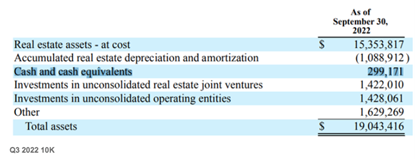

Additionally, improvements to MPW’s balance sheet are in sight too. As of 30 September 2022, it has $299 million in cash and cash equivalents. This will be further bolstered by two deals – the Connecticut and SpringStone Health.

There is the sale of three Connecticut hospitals to Prospect Medical Holdings and Yale New Haven Health has agreed to acquire the hospital operations from Prospect in a contemporaneous transaction at an aggregate sale price of approximately $457 million which is expected to close in 2023 subject to certain regulatory approvals and is further conditioned upon the completion of Yale’s acquisition from Prospect of the hospital operations. That will be an additional $457 million that will be recognized as revenue in 2023.

In August 2022, LifePoint Health’s subsidiary seeks to acquire majority stakes in Springstone Health Opco and upon closing of the transaction in the first half of 2023, Medical Properties Trust expects to receive $200 million in full satisfaction of the loan and retain its minority equity interest and will continue to own and lease Springstone’s behavioral hospitals.

Adding these, we expect MPW’s balance sheet to increase from $299 million to $956 million in 2023.

In the review release, S&P Global states,

“… we are reviewing and reassessing our view of the company’s business risk profile. We expect to resolve the CreditWatch placement within the next quarter.“

With the improvement in Steward’s financial stability and MPW’s balance sheet, and with the anticipated further improvements to be announced in the Q4 2022 earnings call on 23 February 2023, it is very possible that MPW will be removed from this CreditWatch placement.

Management aligns self-interests to the MPW and to Shareholders

Honesty is the best policy – when there is money in it

Mark Twain

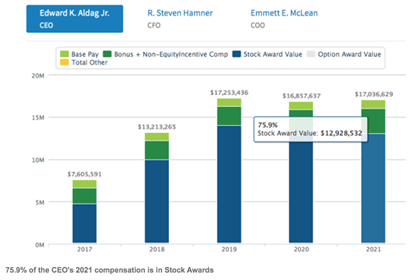

It give us great confidence knowing that MPW management will do their best for shareholders and for the company because their self-interests are aligned through the way their compensation is structured.

All three key figures of the MPW management team – CEO Edward Aldag, CFO Steven Hamner, and COO Emmett McLean – receives the bulk of their executive compensation in excess of 71%-75% in the form of stock awards. This means that they are highly incentivized to ensure that MPW succeeds.

Valuation

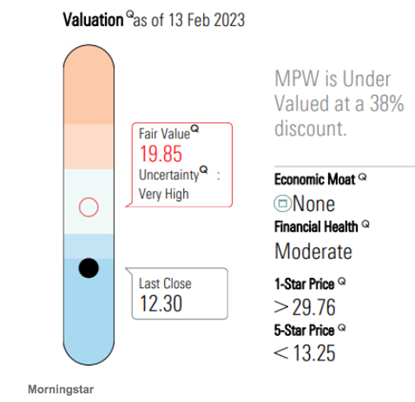

Morningstar assigned MPW a fair value of $19.85, stating that it believes MPW is 38% undervalued.

Based on relative valuation, MPW is severely undervalued.

Note that Morningstar’s five-star price is currently 11.89 and only slightly below its current price.

MPW’s normal P/AFFO for the past 5 years is 12.33, so at a P/AFFO of 9, MPW is currently trading at a 27% discount to its own historical normal. And when compared to its peers on a P/AFFO basis, MPW is trading at a huge discount of 44%-52%.

Taken together, all the above implies that MPW shares should be worth between $17.75 and $27, and averaging that is $21.53 suggesting that MPW is around 40% undervalued at $12.96.

In fact, MPW is so undervalued now that if it simply trades up slightly from the current blended P/FFO of 7.19 to a P/FFO of 7.50, MPW could potentially provide a total annualized return of 10.92% (including dividends). Furthermore, the more moderate yet totally realistic price to P/FFO ratio expansion to its five-year normal P/FFO calculates to more than a 90% return by the end of the year. Simply stated, the perceived risk is already priced in presenting an opportunity for exceptional returns and a high margin of safety.

Summary

What do we know about Medical Properties Trust , before the long-awaited earnings release on 23 February 2023? As Income Investors examining our investments in Medical Properties Trust , the conclusion we arrived at is reassuring from a dividend payment point of view.

Medical Properties Trust is in the hospital business, a mission-critical industry where hospital bankruptcies happen but infrequently compared to other industries.

MPW is a business with rent escalators built into the contracts, and rent revision happens at the start of every year so shareholders can expect greater rental collection revenue from MPW in 2023.

MPW is a business that can comfortably continue to pay dividends at the 2022 rate even if 50% of Steward’s hospitals get into trouble and are unable to pay 50% of the rent. And this bearish scenario is unlikely based on the credit extension it receives from its lender till the end of 2023.

MPW is a business that expects to have almost $1 billion in cash and cash equivalents in 2023 to support its business expansion plans.

MPW is so undervalued right now that the downside exposure is limited, while the upside is far greater, thanks to management’s efforts to address concerns by reducing exposure to Steward, and plans to buy back $500 million worth of shares at a time when the share price is 50% off its high.

MPW’s management’s self-interest is highly aligned with shareholders and the betterment of the company. If they wish to profit from their stock award, MPW has to do well.

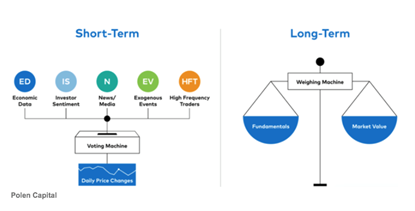

In the short term, the stock market is a voting machine. Asset values can be influenced by economic data, investor sentiments, and of course short reports. The recent ones by Viceroy Research led by Fraser Perring (who uncovered the Wirecard fraud) will only add further fuel to the fire of uncertainty and fear surrounding MPW.

What should long-term investors do?

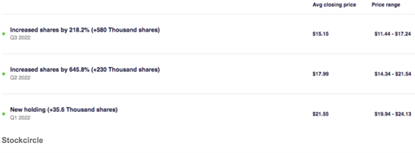

We would study the fundamentals, value the company appropriately, cut out the noise, and invest. Perhaps that was what hedge fund manager and CEO of Citadel Ken Griffin did when he bought more than 230 thousand shares of MPW soon after the second WSJ article about MPW and Hedgeye’s short report came out, and another 580 thousand shares after Hedgeye’s Twitter call on MPW.

Conclusion

Medical Properties Trust offers income-oriented investors what appears to be an exceptional value proposition with an above 9% current dividend yield. The company is expected to report earnings on February 23, 2023 (premarket). The risk regarding investing in a company just prior to its earnings report often represents a 2-edged sword. It can be a great time to take a position or a very bad time. Nevertheless, how a stock trades immediately after an earnings announcement is typically short-lived. In the long run, fundamentals matter and they matter a lot. Consequently, we leave it up to you the individual investor to decide how much risk you are willing to assume. If the announcement is positive you potentially could be missing an opportunity, if the announcement is negative you can be offered and even better opportunity. Regardless, based on the research conducted above, MPW appears to be an excellent long-term bet for the income oriented investor.

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long MPW

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.