Medical Properties Trust (MPW)

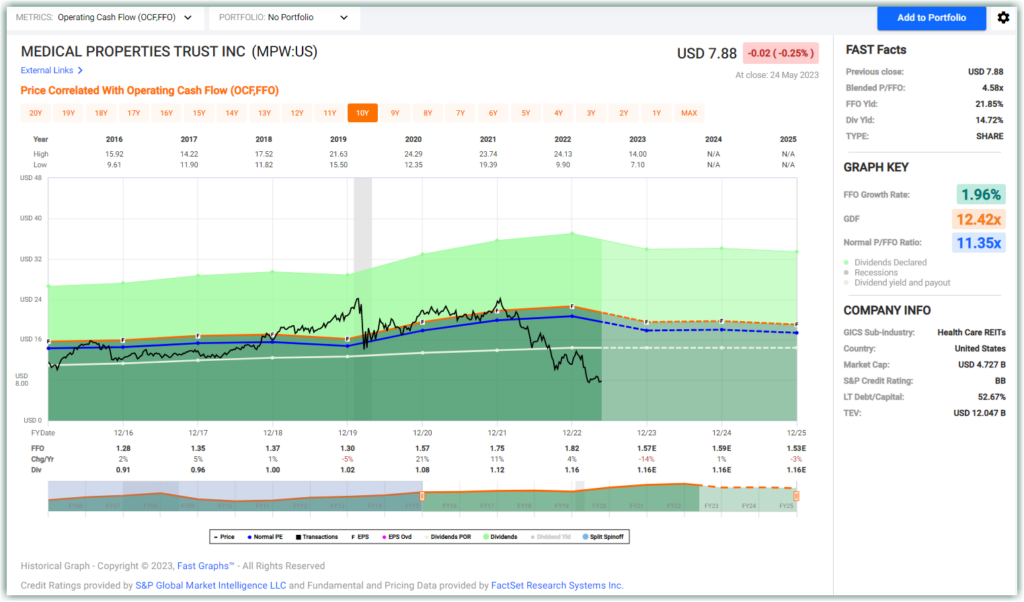

I originally posted a video covering the hospital REIT Medical Properties Trust on February 17, 2023 when the price was $12.96. On February 28, 2023, I did a follow-up update video after the price had fallen to $8.72. In both of those videos I suggested that the fundamentals supported a higher valuation. Nevertheless, the stock price fell to as low as $7.10, and now trades at $7.88.

Here is a link to the first article

Here is a link to the second article

As a result, the most common question I receive from subscribers is do I still like Medical Properties Trust. Additionally, the second most common question I get is can I please do another update on MPW. This has been somewhat frustrating because the only thing that I have seen that has changed materially is the price. From a fundamental point of view, things have actually improved but that has not shown up in the company’s valuation.

As a value investor that believes in investing in great businesses at valuations (prices) that are at least equal to but preferably below the intrinsic value of that business, I have not trusted stock prices, especially short-term prices. Businesses take time to generate value for their shareholders and that time is measured in years, in business cycles, not weeks or months.

Therefore, I would argue that not enough time has passed to make a judgment on whether (or not) MPW is or has been a good investment or not. Thus far, the company has maintained their dividend and fundamentals indicate that it is well covered. But since the stock price has fallen so precipitously, the yield has ballooned to a one time over 15% and currently sits about 14%.

With this video we will cover why we still believe this company has merit regardless of a dividend cut or not. Furthermore, we believe the business is strong enough and possesses significant long-term opportunity to make it a very attractive stock at these levels. We will make our case as clearly as possible with this video. Finally, to answer the questions asked by many subscribers, yes, we still believe MPW is tremendously undervalued at these levels.

FAST Graphs Analyze Out Loud Video On MPW

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long MPW

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.