Introduction

Medical Properties Trust (MPW) claims to be the second largest nongovernmental owner of hospitals in the world.

Furthermore, the company is geographically diverse with properties in United States, United Kingdom, Switzerland, Germany, Australia, Spain, and to a lesser extent in other countries.

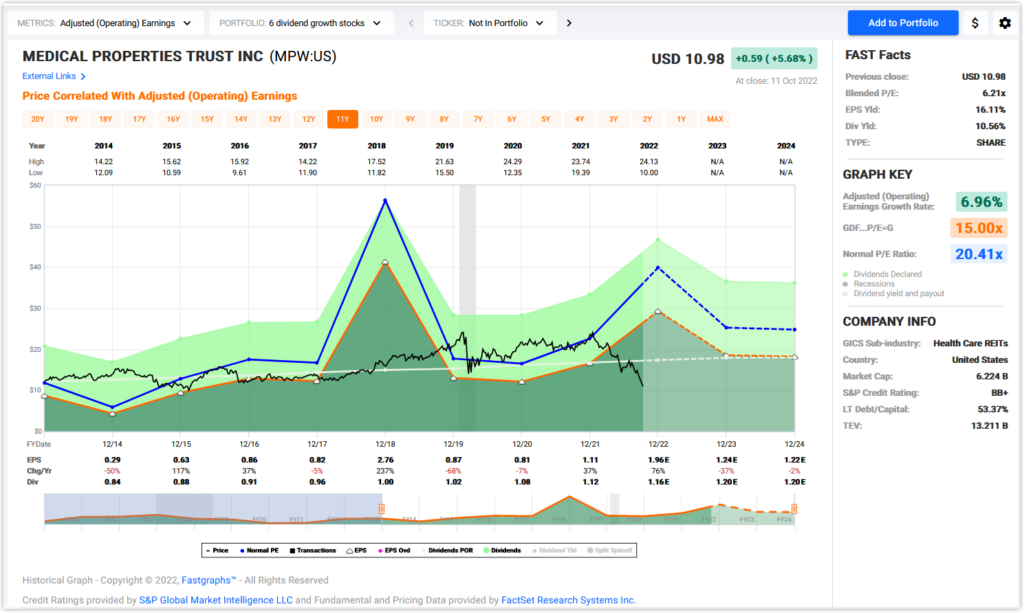

This real estate investment trust has increased their dividend for 9 consecutive years, and currently offers a dividend yield of 11.44%.

However, investors should recognize that today’s dividend yield is significantly above historical norms. Today’s yield is more a function of extreme and even aberrantly low valuation levels that do not appear justified based on fundamentals.

Analysts continue to expect funds from operations (REITs version of cash flows) to remain at current levels for the next two years or so before they return to normal growth.

So far, those estimates are holding up despite concerns about their largest tenant facing some financial difficulties. Part of the reason those estimates are holding up is because Medical Properties Trust has the financial flexibility to support their tenants during distressed times.

The true difference between an incredible value opportunity versus a value trap is fundamental strength and/or stability. Whether investors can accept this or not, Mr. Market often misappraises stock prices (values). Importantly, this works both ways.

Since 2009, Mr. Market has shown a strong tendency to overvalue stocks in general beyond their fundamental values. However, in 2022 that sentiment has abruptly changed from optimism to extreme pessimism.

I have often stated that in the short run emotions can dominate the market, but over the long run fundamentals rule. We have gone through a period of what I can only describe as extreme greed and we are now entering what can only be described as intense fear.

Although I do consider fear to be the most powerful of the two emotions, I also recognize that both fear and greed eventually give way to fundamentals. In the long run stocks will inevitably move into alignment with fair values. This undeniable principle is why valuation is so important.

When you are disciplined to only invest when intrinsic value is present or lower, you position yourself to fully participate in the operating potential of the business you are investing in, or considering investing in.

In the specific case of Medical Properties Trust, the fundamentals are screaming opportunity. Therefore, unless that changes, this may be the income investor’s dream stock.

Although I have not finished my due diligence, and I encourage you to do your own, I am inclined to increase my position in Medical Properties Trust significantly.

The key is to continue to monitor the steward situation and carefully evaluate the actions that management is taking to maintain their strength and opportunity. Caveat emptor.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long MPW.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.