5 Dividend Growth Stocks

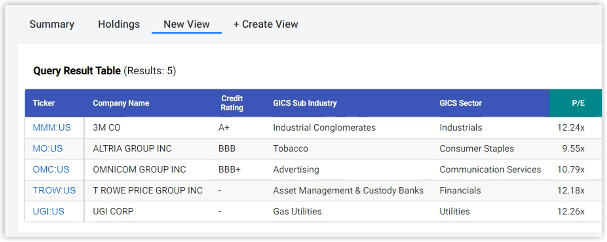

In February of this year, I posted a subscriber request video titled: “5 Premier Dividend Growth Stocks With A Margin Of Safety.” Since that time each of their stock price has fallen as follows: 3M down 15%, Altria down 12%, Omicron down 14%, T. Rowe Price down 30%, and UGI down 9%. Consequently, I received a comment suggesting if I could learn, or if he could learn, from my mistakes by revisiting the stocks.

First of all, I really do not consider any of the dividend growth stocks a long-term mistake. Furthermore, I will fully acknowledge that I have no idea where stock prices will go in the short run. But more importantly, I want to emphatically state that investors would be naïve if they believed anyone – yours truly or otherwise – could forecast short-term stock prices. It is impossible to do except by chance or luck.

On the other hand, it is possible to forecast fundamentals within a reasonable range of accuracy. Not perfectly, because the only thing certain about the future is uncertainty. However, you do not have to be precisely right, only generally correct to successfully invest. This is especially true if you are a long-term oriented income investor and is focused on the dividend and its ability to persist and grow. Fundamentals are simply much more predictable than irrational emotionally-driven short-term price action.

The five dividend growth stocks I will be covering in this video are 3M (MMM), Altria Group (MO), Omnicom Group (OMC), T Rowe Price (TROW), UGI Corp (UGI).

At the end of the day, the most important knowledge the value investor can possess is a reasonable assessment of the value of their investments. Therefore, price anomalies, large or small, will not deter them from experiencing long-term success and accomplishment of their investing goals. Fundamentals matter, and they matter a lot. Stock prices, in the short run, not so much. It takes time for a business to increase its value. Most importantly only by investing in a stock when it is in value or better yet undervalued can you expect to participate in all that the business generates on shareholders’ behalf.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long MMM, MO, OMC, TROW, UGI

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.