Authors: James Long and Chuck Carnevale

Preamble Interpublic Group

Value investors will consider buying stocks that are selling at below or at least at fair value. According to Investopedia,

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors actively ferret out stocks they think the stock market is underestimating. They believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond to a company’s long-term fundamentals. The overreaction offers an opportunity to profit by buying stocks at discounted prices—on sale.

FAST Graphs Analyze Out Loud Video on IPG

Of course, there are other important factors to consider such as the strength of the business, growth prospects, moat, etc., but ultimately it is the price that one purchases an asset at that determines if an investment will be a great one or a dud. A fantastic company bought at an insanely rich price will require years of waiting before price appreciation happens, and nobody knows what may happen (competition catches up, moat gets eroded) during the long wait.

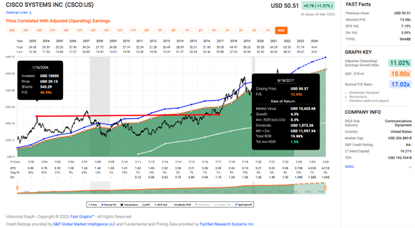

Take CISCO (CSCO) for instance.

It was ranked among the top ten largest companies in the world in 1999, 2000 and 2001. However, if one had bought CSCO at $29.13 in 2004 when it was extremely overvalued, even if one had patience and held it for 13 years, the stock would still have only broken even.

There are many places value investors go to look for value. One such method is to look through beaten-down sectors and industries to find the gems among the rough. Many stocks tumble because they deserve it. Many however do not deserve the same treatment, and just because Stock A is in the same industry as Stock B, when Stock A falls often Stock B falls in sympathy.

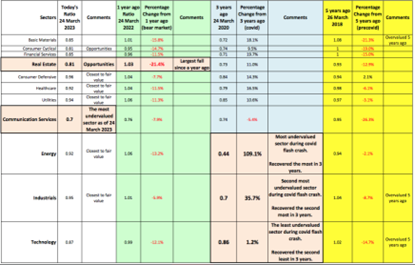

Let’s take a look at the table below. The values were taken from Morningstar fair Value page that provides a fair value assessment of the stocks that it covers in its universe. A ratio above 1.00 indicates that the stock’s price is higher than Morningstar’s estimate of its fair value. The further the price/fair value ratio rises above 1.00, the more the median stock is overvalued. A ratio below 1.00 indicates that the stock’s price is lower than our estimate of its fair value. The further it moves below 1.00, the more the median stock is undervalued.

Three years ago, the two worst-performing sectors during the Covid flash crash were Energy and Industrials. When the whole world went on lock-down for months in the face of an unknown global threat, when shops shuttered and folks stayed at home, it was understandable that people would think that no one would ever drive a car or fly in a plane anymore, or that the transportation of goods and services would come to a standstill and companies that produce machinery, equipment, and supplies used in construction and manufacturing would go bust. Companies in the Energy and Industrial sectors became badly hit and their intrinsic value, according to Morningstar Fair Value measure, fell to under 60% and 30% respectively from their fair value. Fast-forward three years from 2020 and these are the two best-performing industries. The Energy sector has more than doubled in value, while the industrials gained 35.7%.

Based on Morningstar’s Fair Value measure as of 24 March 2023, the sector that is most undervalued currently, is Communication Services. Another area where value investors can find opportunities will be in the Real Estate sector since that sector declined the most in the past year.

A value investor can consider investing in the best companies in these two sectors when the future was most uncertain and almost certainly bleak, or during the proverbial “blood in the streets” moment because it is the best companies that will survive and come out on top. Markets tend to move in cycles and the value investor just need to have conviction in the analysis, trust in the management to handle any near-term crises, sit tight, and wait for the storm to pass. It may take a year, two years or even longer for a thesis to play out, and during the holding period the stock price may fall even more. Huge price declines in perfectly great companies provide huge mispricing opportunities for value investors. One must not confound price volatility with risk. Stock prices can rise or fall on a whim without a care for business fundamentals.

And that was precisely why Peter Lynch said in an interview with PBS that the most important organ for investors is not the brain but the stomach.

If you’re in the market, you have to know there’s going to be declines. And they’re going to cap and every couple of years you’re going to get a 10 percent correction. That’s a euphemism for losing a lot of money rapidly. That’s what a “correction” is called. And a bear market is 20-25-30 percent decline. They’re gonna happen. When they’re gonna start, no one knows. If you’re not ready for that, you shouldn’t be in the stock market. I mean stomach is the key organ here. It’s not the brain. Do you have the stomach for these kind of declines?”

We recently covered Realty Income Corporation (NYSE: O) in a Fast Graph video, a top-notch company in the Real Estate sector. In this article, we will analyse a company in the Communication and Services sector that we think investors should have on their radar.

Introduction on the Communication and Services Sector

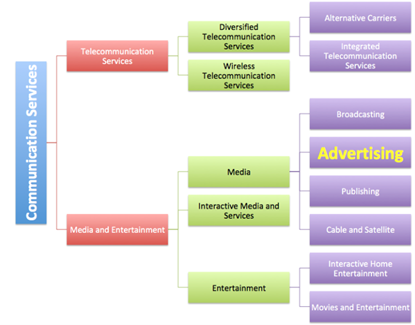

The Global Industry Classification Standard (GICS) is an industry taxonomy developed in 1999 by MSCI and Standard & Poor’s (S&P) for use by the global financial community. The GICS structure consists of 11 sectors, 25 industry groups, 74 industries and 163 sub-industries, and Communication and Services is one of these 11 sectors.

See flow chart below. Our focus will be on a company in the Advertising sub-industries.

International Monetary Fund managing director Kristalina Georgieva said IMF expects the 2023 to be “tougher than 2022 because the three big economies – the US, EU and China – are all slowing down simultaneously.” Even countries that are not in recession, “it would feel like recession for hundreds of millions of people,” she added.

Surprisingly, many companies are still reporting record revenue and profits in Q1 of 2023, because they managed to pass rising costs to consumers. If a recession is coming, and if inflation is going to be sticky and remain high for the rest of 2023 and perhaps even in 2024, more companies may not be able to pass costs on as much as before, leading to narrowing margins and lower profits.

What will companies’ management do in an adverse environment? Cut cost because reducing expenses will help to artificially boost earnings per share. Many companies – think Amazon, Meta, Google – have already announced layoffs numbering in the tens of thousands, and it will not be surprising to expect more to come. Other than layoffs, cutting advertising costs is definitely on the table.

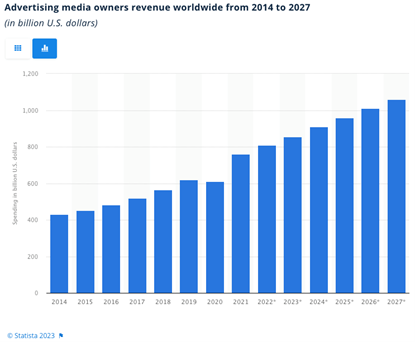

One may think that investing in advertising companies at this junction is a questionable decision. If the investment holding period is less than one year, perhaps that is true. However, we are talking long-term investment here. Despite the inevitable cost-cutting measures and reduction in advertising costs, almost every company needs to advertise come rain or shine. In today’s world, consumers are spoiled for choices. During good times, companies advertise more in an effort to push their products and services out to potential consumers ahead of their competitors. During bad times, although companies are likely to cut advertising budget first, they will still need to maintain a certain level of their advertising spend so as not to lose market share to their competitors. Based on research by Nielsen, long-term revenue can take a 2% hit every quarter a brand stops advertising. No company, especially large ones like Apple that brought in $394 billion in 2022 can afford a 2% hit every quarter as that will translate to theoretical $7.88 billion decline in revenue for the full year. Ouch.

Therefore, if investors can take a stake in the best advertising companies, and ride through this down cycle, when advertising spending returns with a vengeance, earnings are likely to skyrocket.

That is why our stance is the sub-industry “Advertising” offers one of the greatest opportunities for mispricing – and hence unreasonable price fluctuations – to happen, which provide opportunities for value investors.

The Best Advertising Company (now)

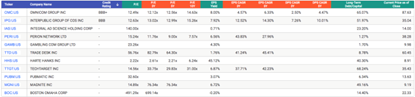

There are many companies in this sub-industry of Advertising. In the path to finding the strongest companies, after removing the unprofitable ones and the penny stocks, these 11 companies remain.

Note: We understand that technology companies like Google and Facebook are also advertising companies. However, our search criteria is based on funneling stocks by first looking at the most undervalued sector, which in this case is Communication Services, and Google and Facebook are both not classified in this sector.

Based on a relative PE basis, OMC, IPG, TTD, TTGT, HHS and MGNI are all trading below their 3-year and 5-year PE.

And among these, OMC, IPG, HHS and TTGT are trading below their 3-year, 5-year and 10-year PE. Of these companies, only two companies have investment-grade credit ratings. OMC is rated BBB+ and IPG is rated BBB.

In tough times, companies may need to take out loans or tap into their revolving credit facilities, and having an investment-grade credit rating (perceived as safer and more financially stable) will allow the companies to borrow at more favorable rates. Omnicom (NYSE: OMG) and Interpublic Group of Companies (NYSE: IPG) are among the largest advertising companies in the world, both with long operating histories and experience working with numerous multinational companies. Between the two, we prefer IPG for their high EPS and DPS CAGR, and the lower long-term debt-to-capital ratio.

Investment Thesis

Interpublic Group of Companies (NYSE: IPG) is a value-investor candidate for total return. IPG is a BBB rated company that has paid a growing dividend for the past 11 years, even through the pandemic years. It is currently trading at an attractive valuation and despite a widely expected recession or economic slow down in the back half of 2023, IPG is still confident of producing 2%-4% of revenue growth. Combine that with a 6%-7% dividend growth rate, even if IPG trades at the current valuation it is reasonable to expect a total 8%-11% return by the end of 2023. And if IPG were to trade up to its normal PE of between 13-14, it could potentially return 11.95 % (including dividends) in a year.

An Overview of IPG

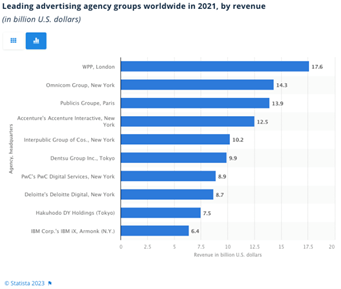

Interpublic Group is consistently among the top 5 leading advertising agencies in the world, and it is the third largest in the US in terms of revenue after Omnicom Group and Accenture’s Accenture Interactive.

Interpublic Group is a holding company with numerous top advertising brands under its fold. The role of the holding company is to provide resources and support to ensure that the various agencies under Interpublic Group can best meet clients’ needs and to facilitate collaborative client service among the different agencies. The holding company sets company-wide financial objectives and corporate strategy, establishes financial management and operational controls, guides personnel policy, directs collaborative inter-agency programs, conducts investor relations, manages environmental, social and governance (“ESG”) programs, provides enterprise risk management and oversees mergers and acquisitions. As a whole, Interpublic Group is positions itself as a provider of multiple services and capabilities to meet the diverse and complex needs of its clients.

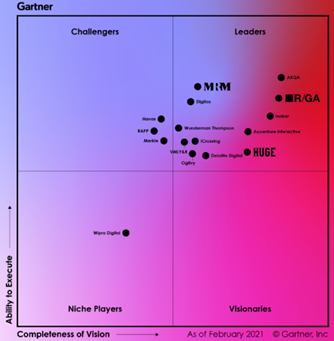

Interpublic Group owns some of the best brands in the world, such as R/GA, Huge and MRM, and many of these were recognize by Gartner as Leaders among the Global Marketing Agencies.

However, it will be incomplete to think of Interpublic Group as just an advertising and marketing company producing and selling advertisements.

For instance, Interpublic Group made a $2 billion acquisition of Acxiom in 2018 to bring in expertise in identity, data, integrations and data stewardship, to leverage data at scale to enable IPG to develop deeper relationships in the marketplace, and to position the company for a future in which data-driven marketing solutions will be increasingly core to brands’ success. That acquisition allows IPG to utilize tools to break down data silos, activate data across both digital and offline channels to provide outcome-driven services delivering targeted brand experiences that integrate disparate channels, advertising and marketing technologies, and data across the customer journey.

More recently in 2022, IPG spent $232 million to acquire RafterOne so it can merge IPG’s media, creative, marketing services and analytics capabilities, global scale and consumer insights, with RafterOne’s Salesforce capabilities for commerce, service, data, marketing and customer experience. IPG recognises that enterprise marketing suites like Salesforce formed the foundation of so many brands marketing technology stacks, and by owning RafterOne’s Salesforce capabilities, IPG can serve as a bridge between those brands, their consumers and these platforms, strengthening every touch point in the customer journey, value-adding IPG’s service offerings and making them even more sticky.

What are IPG’s Reportable Segments?

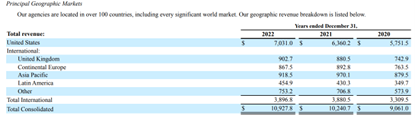

IPG operates in over 100 countries. Most of IPG’s revenue – 64% – come from the US, and the rest coming mainly from Asia Pacific (8.4%), UK (8.25%), Europe (7.93%), Latin America (4.15%) and the remaining 6.89% from the rest of the world.

The Interpublic Group of Companies, Inc. provides advertising and marketing services worldwide. It operates in three segments: Media, Data & Engagement Solutions, Integrated Advertising & Creativity Led Solutions, and Specialized Communications & Experiential Solutions.

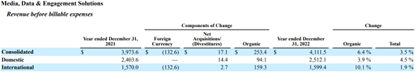

Firstly, the Media, Data & Engagement Solutions segment provides media and communications services, digital services and products, advertising and marketing technology, e-commerce services, data management and analytics, strategic consulting, and digital brand experience under the IPG Mediabrands, UM, Initiative, Kinesso, Acxiom, Huge, MRM, and R/GA brand names.

The organic increase was mainly attributable to net client wins in our financial services sector and net higher spending from existing clients in our retail and other sectors. The 3.9% organic increase in its domestic market was driven by increases at its media businesses and data management and analytics.

In our international markets, the 10.1% organic increase was driven by growth across all disciplines, primarily at its media businesses, and was most notable in the Continental Europe, Latin America and Asia Pacific regions.

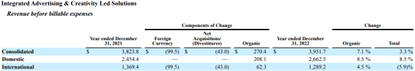

Secondly, the Integrated Advertising & Creativity Led Solutions segment offers advertising, corporate, and brand identity services; and strategic consulting.

The organic increase was mainly attributable to a combination of net higher spending from existing clients and net client wins in the healthcare, other and financial services sectors. The 8.5% organic increase in the domestic market was driven by growth in the advertising businesses.

In the international markets, the 4.5% organic increase was driven by growth in the advertising businesses, and was most notable in the Other region led by the Middle East and Canada.

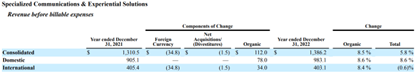

Thirdly, the Specialized Communications & Experiential Solutions segment provides public relations and other specialized communications services, events, sports and entertainment marketing, and strategic consulting.

The organic increase was mainly attributable to net higher spending from existing clients in the technology & telecom, auto & transportation and food & beverage sectors and net client wins in the healthcare sector. The 8.6% organic increase in the domestic market was driven by revenue increases at both the experiential businesses and public relations agencies.

In the international market, the 8.4% organic increase was driven by growth at both the experiential businesses and public relations agencies, and was most notable in the United Kingdom, Asia Pacific and Continental Europe regions.

These high single-digit organic revenue growth rate reported across all most of the three business segments are very encouraging.

Let’s dig deeper into the performance and the fundamentals.

Performance

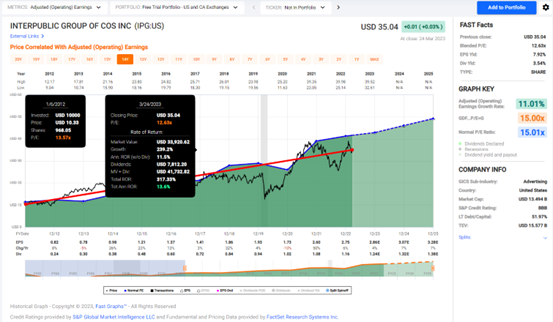

As IPG is our candidate for total return (price appreciation and dividends), we are examining IPG from 2012 since that was the first year IPG started growing its dividends.

As alluded to previously, when the economy is booming, more advertising dollars are spent, and IPG’s business will be great. Likewise, when the economy tanks, IPG’s business will not do so well. In other words, IPG’s fortune is tied closely to the global economy, and that explains the close correlation between its annualized rate of return (before dividends) when compared to the S&P 500.

As IPG grows dividends at a higher rate than the S&P 500, that helps to boost its total returns to beat the S&P 500 slightly by 1.74%. IPG is certainly a company that has performed well enough over the past 10 years.

From 2012 to 2022, IPG grew sales, net income, and net operating income by high single-digit rates, which is hardly mind-blowing but respectable nonetheless. As investors who believe that we are co-owners of the companies we invest in, it is always important to see that the business can grow be it through merger and acquisitions or organically, and as reported earlier, IPG is capable of growing organically both domestically as well as the international markets.

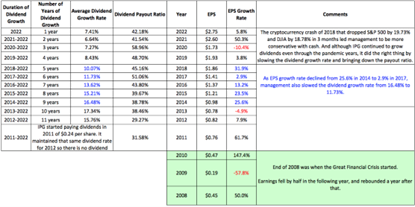

However, what is more impressive is the past 10 years dividend CAGR of 18.35%. It is also worth noting that IPG continued to pay and raised dividends through the pandemic, which is remarkable in itself. IPG seems to fit the bill for dividend growth investors. More on this in the Risk section.

3 Risks and Considerations

(1) Dividend Growth Rate Has Declined

The long-term average dividend growth rate is impressive but dividend growth investors should be aware that IPG’s average dividend growth rate has declined over the past 10 years.

A 6%-7% dividend growth rate is still respectable but definitely not impressive. Rather, the dividend growth rate seems to reflect the EPS growth rate (see Comments in the table above).

The declining dividend growth rate also telegraphs management’s outlook for the future. One must understand that as IPG works closely with global companies, it has the pulse on the health of the global economy. Since advertising budgets are often cut first when companies need to boost their earnings in preparation for worsening times, and if enough companies across geographies are cutting their budgets (IPG has offices in over 100 countries), IPG will know firsthand, and can batten down the hatches. And it has been doing that, reducing its global real estate footprint by 15% or 1.7 million square feet to reduce operating costs. SG&A expense was reduced by 10 basis points to 1.2% of net revenue.

(2) IPG Will See Less Growth in 2023 Compared to 2022

In the 2022 Q4 earning call, CEO gave the following guidance,

As stated earlier, despite the broader uncertainty that we’re seeing at a macroeconomic level, we expect to deliver growth in 2023 of 2% to 4% on top of a very strong record that has compounded for a number of years

The CEO expressed that the 2023 growth strategy will be based on generating more revenue from existing customers.

So if I were to talk about what’s gone into our thinking and how we build the forecast that leads to the guidance, revenue growth is primarily from growing scope with our existing clients. And we definitely believe that there is that the primary avenue for growth, the most — the one that we are most keen on is growth with existing clients.

Each sector has its own growth cycle, and they are sending mixed growth signals. Some sectors are still seeing strong growth – and hence needing greater advertising expenditure, while other sectors are facing headwinds – and hence a decline in advertising revenue.

And then I guess on sectors, so auto and transportation is strong, and we see it continuing. Health care, financial services for us, given the mix of clients that we’ve got in retail, that has continued to be a place where we’ve got quite progressive modern clients…

(Note: The above comment by the CEO was made before the bank fiasco with the collapse of Silicon Valley Bank, Silvergate and Signature Bank, so growth in the banking sector should decline as banks seek to bolster their cash position by reducing costs)

As I mentioned, I think the – a lot of the headlines and a lot of the sort of sector-specific issues that we’re seeing in tech are manifesting in conversations with clients. And there, what we’re seeing is clients either taking reductions or being not committing for a full year.

(3) Can IPG Sustain Its Dividend?

IPG dividend payout ratio stands at 42.2%. That seems safe enough especially when that is at a lower payout ratio compared to 5 out of the previous 7 years. However, we will be remiss if we do not highlight the following.

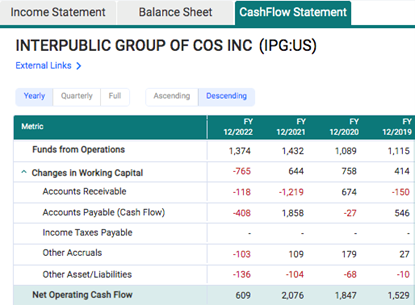

IPG paid $457 million in dividends in 2022. The operating cash flow of $606 million was enough to cover the dividends, but IPG’s free cash flow of $430 million is less than the dividends paid out.

All of us understand the importance of free cash flow. Free cash flow is the cash flow available for the company to repay creditors or pay dividends and interest to investors so when the free cash flow is insufficient to meet the dividend distribution, this is definitely a red flag.

This is the first year this has happened since the company started paying dividends.

Why did that happen?

Net cash provided by operating activities during 2022 was $608.8 million, which was a decrease of $1,466.8 as compared to 2021. The decrease was driven by an increase in IPG’s working capital use and this comparison includes $672.3 million used in working capital in 2022, compared with $743.4 million generated from working capital in 2021.

Working capital in 2022 was impacted by client spending and timing of collections and payments. Net cash used in investing activities during 2022 consisted primarily of payments for acquisitions, net of cash acquired, of $232.2 million related to the acquisition of RafterOne which closed on October 3, 2022, as well as payments for capital expenditures of $178.1 million, related mostly to computer software and hardware.

Investors have to understand that the nature of the contracts IPG’s agencies sign with their clients. Many companies put their advertising and marketing communications business up for competitive review from time to time, and IPG have won and lost client accounts in the past as a result of such periodic competitions. For instance, in Q4 2022, IPG felt the largest quarterly impact of the late 2021 loss of a large food and beverage client which will finish running off at the end of Q1 2023.

How are the contracts structured? Clients may choose to terminate their contracts, or reduce their relationships with IPG, on a relatively short time frame – usually 30 to 90 days – and for any reason. Only the data management contracts typically have non-cancelable terms of more than one year. Although the majority of the contracts have written into them the ability to negotiate with clients about the cost of the services that IPG provides to them, that however is not something that triggers automatically. That provision requires IPG to enter into a negotiation with its clients.

In addition, in most of IPG’s businesses, its agencies enter into commitments to pay production and media costs on behalf of clients, as is customary in the advertising and marketing industries. To the extent possible, IPG pays production and media charges after receiving funds from its clients, and in some instances IPG agrees with the service provider that it will only be liable to pay the production and media costs after the client has paid IPG for the charges. It is definitely possible for IPG’s clients to delay payment, resulting in IPG needing to pay the production and media costs in advance, which in turn adversely affected its working capital.

This is most likely an aberration but investors should keep an eye on this.

Valuation

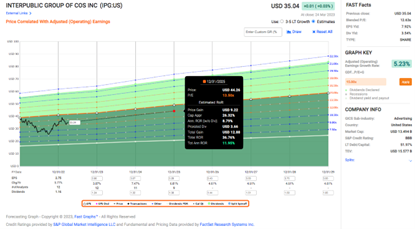

IPG is currently trading at a PE of 12.74, below its 5-year average of 13.98 and below the sector median of 13.97.

If IPG is able to trade close to its 5-year average PE at 13.5, it could potentially offer an annualized rate of return of 11.95% by 2025.

Summary

Interpublic Group of Companies (NYSE: IPG), a BBB rated company that has paid a growing dividend for the past 11 years even through the pandemic years, is a value-investor candidate for total return. As a business, IPG operates in the unique advertising industry. It is one that businesses seek to reduce spending during bad times to conserve cash, and increase spending during good times, but find themselves almost unable to do without at all times as a failure to advertise can result in revenue lost of up to 2% per quarter. Even during the bear market of 2022, IPG demonstrated that it could grow organically at high single-digit rate both domestically and internationally in almost all its three business segments.

IPG is currently trading at an attractive valuation and despite a widely expected recession or economic slow down in the back half of 2023, IPG is still confident of producing 2%-4% of revenue growth. Combine that with a 6%-7% dividend growth rate, even if IPG trades at the current valuation it is reasonable to expect a total 8%-11% return by the end of 2023. And if IPG were to trade up to its normal PE of between 13-14, it could potentially return 11.95% (including dividends) in a year.

Advertising spending is not going away, and definitely not for IPG, which is one of the top 5 largest advertising companies in the world. By 2026, the advertising market is expected to cross the one trillion dollars mark.

Sure, there will definitely be competition, but IPG will definitely be getting a slice of an ever-growing pie. IPG’s geographical reach across more than 100 countries and its continued investments into data analytics and Salesforce capabilities will give it an edge in coordinating coherent messaging no matter where one’s customers reside.

Conclusion

Interpublic Group (IPG) is an investment grade dividend growth stock that appears currently undervalued relative to historical norms and future expectations. It is important to note that the company’s stock price rallied significantly towards the end of 2022 after falling precipitously for most of the year. Consequently, prospective investors need to be cognizant that stock price could temporarily falter before it reverts back to fair value. Nevertheless, prospective investors can take solace in the reality that the stock price has risen back to realistic valuations when it faltered in the past. Long-term investors looking for growing income might consider placing IPG on their watch list.

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: James Long is Long IPG

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.