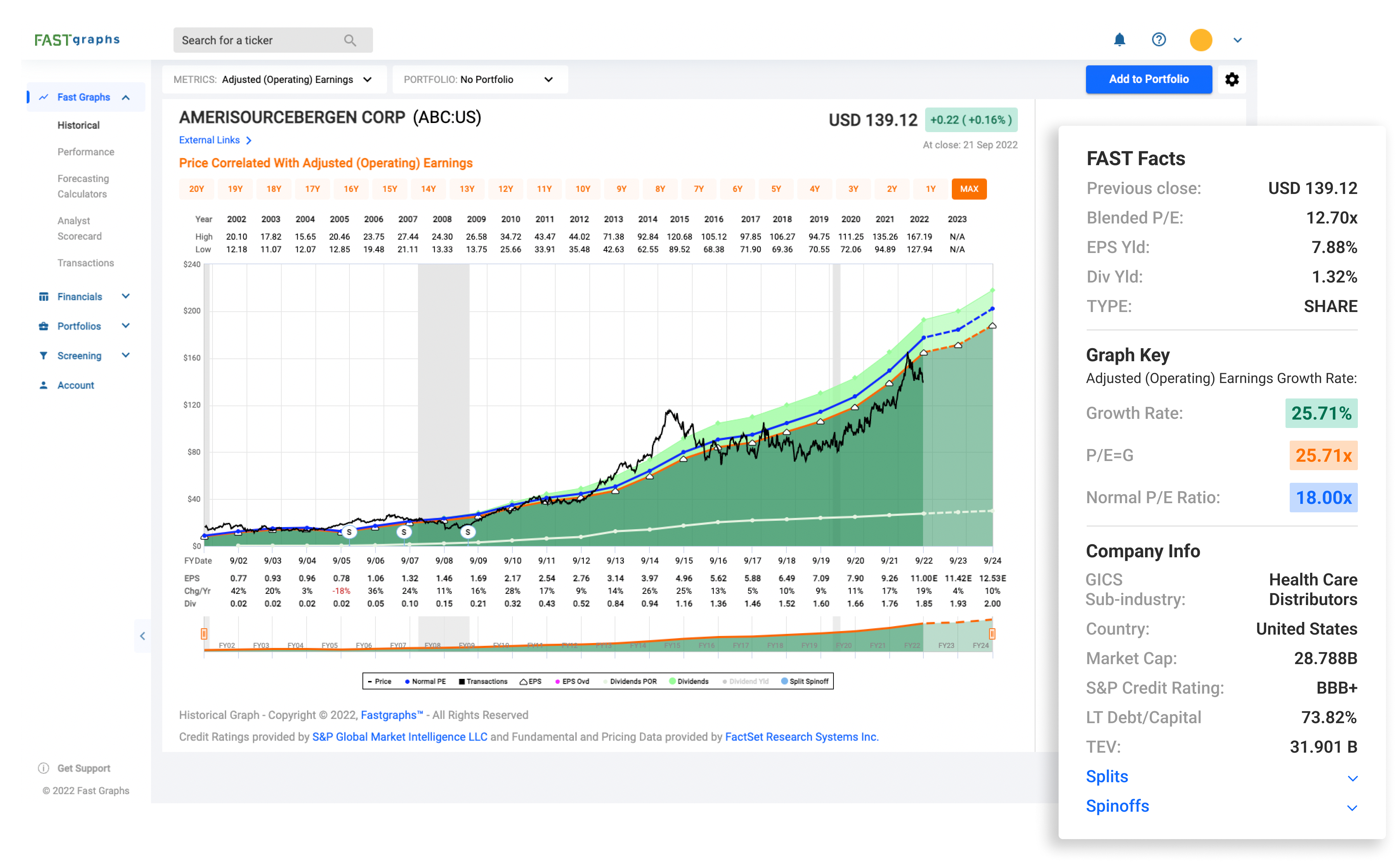

Make safer and more profitable Investment decisions

Everyone wants to know when to buy, sell, or hold a stock. FAST Graphs reveals this by clearly illustrating the value of the business relative to its stock price.

Become a better investor with FAST Graphs

Investing in good businesses is key to above-average returns, and FAST Graphs helps you identify those businesses faster than ever before. Simple, but interactive, charts quickly let you identify valuation so you know when to buy, sell, and hold a stock.

How it works

Quickly know when to buy, hold and sell stocks correctly

This stock is Undervalued

The shares are undervalued, since the company’s income (orange line) is significantly higher than the current value of the shares (black line), it suggests the price should rise.

This stock is Fairly valued

When stocks are fairly priced (the black line is close to the orange line), consider maintaining your positions or even buying more. Buying at this stage still represents a great investment.

This stock is Overvalued

The company here is significantly overvalued, shown by the black line being much higher than the orange line. Owning shares here have considerably more risk of losing capital. Consider harvesting gains and reducing your positions.

Our solutions

Investing isn’t easy, but a tool like FAST Graphs assists in the process – for beginners and professionals