Dividend Growth Stocks

In part 1 I covered a model portfolio that was built on August 24, 2021, with the primary objective of generating a higher level of current income safely. To repeat and clarify, the primary focus was for the highest level of current income possible without taking on undue risk. In theory, equal weight income model was designed for people who were spending dividend income generated by the portfolios and wanted to see some income growth in the future.

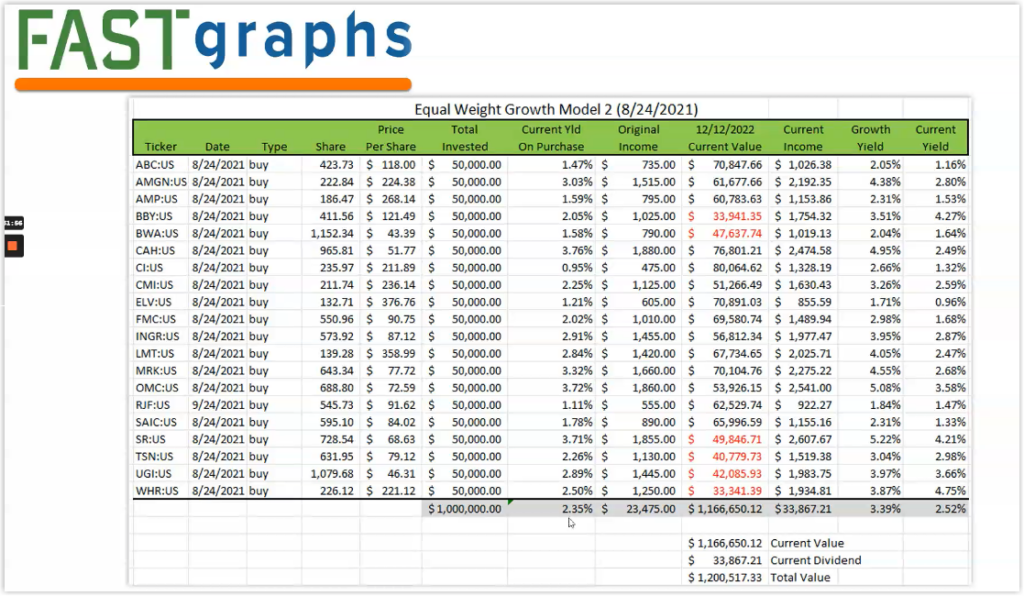

In part 2 I am covering the equal weight growth model that although possessing similar income objectives, was more focused on growth of income than current income. This kind of strategy that best applies to investors who still had time ahead of them before they were requiring their portfolios to provide them income. Consequently, they wanted to see both the principal as well as the income growing as fast as safety and prudence would allow.

Consequently, the equal weight growth model was willing to accept faster growing companies with lower current dividend yields, but faster growing dividends. In theory, these stocks would be capable of providing not only growth of principal, the growth of income into the future.

In summary and conclusion, it is important to point out that the strategies being employed here are only examples of the types of strategies that can be employed. These strategies can be tweaked in many ways. For example, some investors might be more comfortable with 30, 40, 50 or more stocks rather than just 20. So I do want to be clear, that the examples utilizing 20 stocks were for illustrative and educational purposes only. However, recent studies have indicated that once a portfolio gets bigger than 18 stocks, most of the benefit of diversification has been utilized. Nevertheless, I believe it is critically important that investors construct portfolios that they are comfortable with. Therefore, it will be able to stay the course during the inevitable volatile times that are sure to follow.

Here is a link to the first video Finding 20 Dividend Growth Stocks In A Bad Market

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long ABC, AMGN, AMP, BWA, CAH, CI, CMI, ELV, INGR, LMT, MRK, OMC, UGI, WHR

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.