Introduction Dividend Stocks

Subscribers have requested that I cover 5 dividend stocks with yields ranging from 2.5% to 9.5%. What I find interesting about these requests is how different each of these companies are and how investors wanted to know more about them.

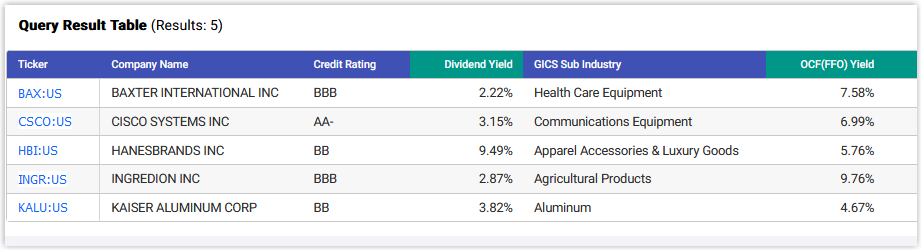

Of course, I clearly understand the allure of a 9.5% dividend yield. Even though interest rates have been on the rise, 9.5% is still a very enticing yield. But the real questions are, is the dividend safe and is the company paying the dividend an attractive investment or not? The lowest yielding dividend stock paying 2.25% in contrast might be the better long-term choice. It is certainly a higher quality company and has also fallen precipitously in 2022. But again, in contrast, the stock fell from being overvalued to now being fairly valued while fundamentals remain solid. However, the 9.5% yielder saw both price and fundamentals collapsed in tandem.

In my opinion, I appreciated the opportunity to cover these 5 companies because I believe there are prudent value investing lessons with each. Statistics alone without a proper perspective can lead investors down the path of loss and high risk. In summary, sometimes lower yields and higher valuations eventually translate into better profits and lower levels of risk. The principal point is that fundamentals matter, and they matter a lot.

In this video I will cover Baxter International (BAX), Cisco Systems (CSCO), HanesBrands (HBI), Ingredion (INGR), Kaiser Aluminum (KALU)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long CSCO, HBI at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.