Blackstone Inc (BX) Introduction

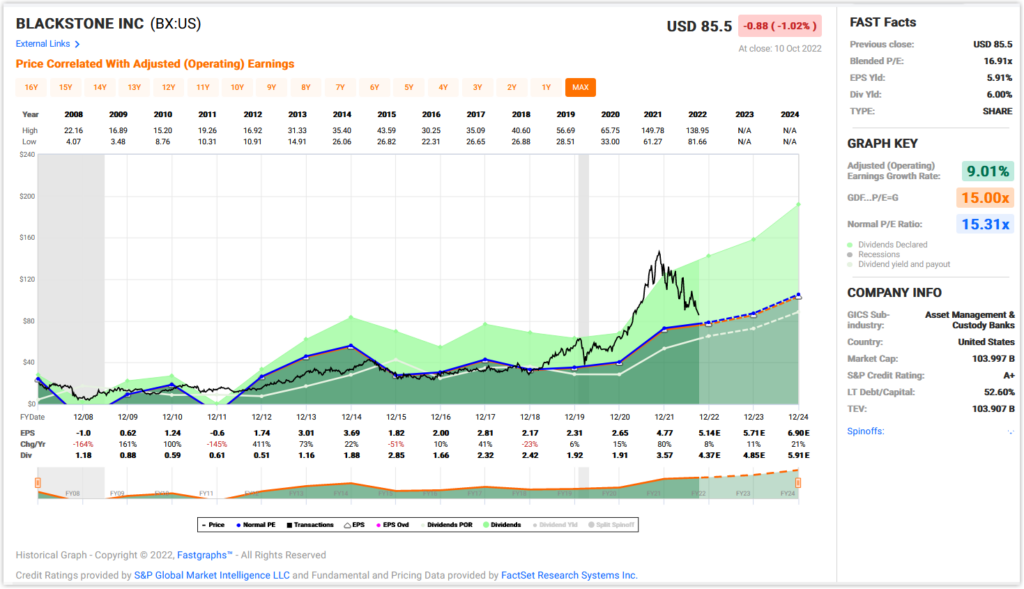

Blackstone Inc (BX) operates in the Asset Management and Custody Banks subindustry and is the largest alternative asset manager in the world. The company is A+ rated and currently offers a dividend yield exceeding 5.5%, which at first glance appears enticing. However, closer scrutiny shows that the company has a very inconsistent operating history and often pays out more in dividend income than it earns. The question is, can prudent dividend growth investors trust that the company’s dividend and meet their income needs? In this video, I will run Blackstone by the numbers over their historical operating history and discuss their prospects for sustained growth. I was asked to review this company by subscribers and only feel fair in disclosing that it is not a company that meets my personal investing goals. However, also in the spirit of fairness, I will let the individual investor decide for themselves. Hopefully, this video will provide perspectives that will prove helpful to viewers deciding for themselves.

The main reason I invest for dividend growth is for dividend growth. As redundant as that sounds, it is actually very important. I believe that dividend investors deserve a raise in pay each year. When this happens, their portfolios have a built-in inflation protection. Consequently, I prefer dividend paying companies that possess long-running consistent periods of increasing their dividend. Therefore, not only is consistency important, so is dividend growth. With that said, I do not object to mingling a slower growing high-yield dividend growth stock with a faster growing lower yielding payer. At the end of the day, I am looking for an average dividend growth rate that exceeds inflation.

Blackstone Inc. does possess a long-term history of outperforming the average company as measured by the S&P 500 on both capital appreciation and total dividend income. On the other hand, as previously stated, operating results tend to be cyclical resulting in several dividend cuts since the company went public in 2007. Since that time Blackstone produced total dividend income more than 3 times higher than the S&P 500. However, the numerous dividend cuts could be problematic. Nevertheless, if you are investing for dividend income and can tolerate the occasional dividend cuts, Blackstone might be a rational addition to your dividend portfolio. Whether or not you should consider Blackstone requires that as an investor you know thyself.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: No position.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.