Bristol Myers Squibb

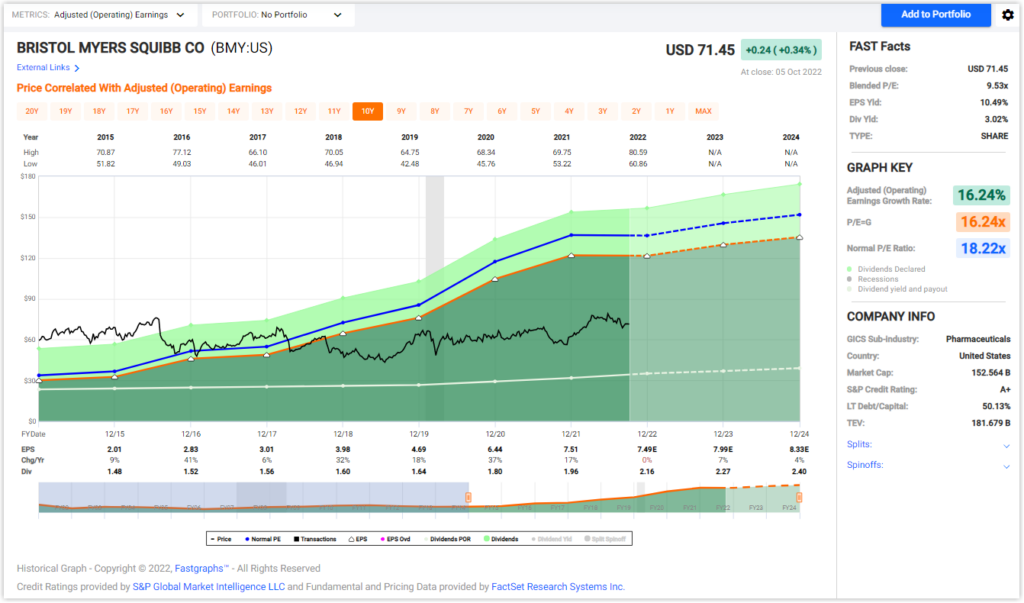

A+ rated Bristol Myers Squibb (BMY) is a blue-chip dividend growth stock offering a 3% and growing current yield. Historically, this stalwart pharmaceutical giant has commanded a premium valuation multiple by Mr. Market. However, since November 2018 Bristol Myers has been selling at a discount to not only its historical norms but historical market norms as well. Despite this low valuation, the company has outperformed the S&P 500 on both dividend income and capital appreciation. Furthermore, this low valuation also supports an opportunity for outsized future gains at below-average levels of risk. In addition to the company’s extremely high quality, the significant undervaluation provides a margin of safety as an additional layer of risk mitigation.

In this video, I will be running Bristol Myers Squibb by the numbers via the FAST Graphs fundamentals analyzer software tool. In addition to providing a fundamental analysis of the company, I will simultaneously be illustrating the power of the FAST Graphs research tool as well as how to use it to your maximum benefit.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long BMY at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.