Introduction

First and foremost, the title of this article does not refer to people who use stop losses in their investing strategies. Instead, the title of this article refers to the actual status of the common stock that the stop loss is placed upon. Therefore, a clear and specific definition of a loser is required for clarity. In general terms, our definition of a loser is a common stock that should not currently be owned in the first place. There are two primary reasons why this would be true. Either the company’s fundamentals are permanently deteriorating, or the company’s stock price is irrationally overvalued.

To be clear, this article is offered to present the argument that placing a stop loss order on a winning stock is a strategic mistake. Our definition of a winning stock is when their fundamentals are strong and where the markets were pricing them appropriately when first purchased. Then, if their stock price falls due to irrational market behavior but their fundamentals remain intact, the winning stock simply goes on sale. In other words, the stock begins trading at a valuation that is below its intrinsic value. To the astute investor, this represents a buy signal, not a sell signal.

The basic principle and thesis is simple and straightforward. We contend that it is never a good idea to sell an investment for less than it’s worth. In other words, we believe it’s always a mistake to sell a stock when it is trading at less than its intrinsic value. If a thorough and careful calculation of True Worth™ was originally conducted before a common stock was purchased, then placing a stop loss only serves the purpose of potentially locking in an unnecessary loss.

An unrealized loss can quickly turn into an unrealized gain if the principles of sound valuation are heeded. Therefore, it is our contention that the better strategy is to buy more of a winner that has gone on sale. The cornerstone of all successful investing strategies is to buy low and sell high. Buying high and then selling low is a poor way to manage your investment portfolio. However, in order to be able to do this with confidence, the investor must have a valid method of determining True Worth™. The best, and dare we say only way to do this, is to evaluate the company based on fundamentals rather than price movement.

We often state, and it is mostly ignored, that measuring performance without simultaneously measuring valuation is a job half done. Furthermore, we believe that by applying sound principles of business, economics and accounting, a reasonable estimation of intrinsic value can be made. The following quote from the legendary investor Marty Whitman, Chairman of the Board, Third Avenue Value fund, puts this clearly into perspective:

I remain impressed with how much easier it is for us, and everybody else who has a modicum of training, to determine what a business is worth, and what the dynamics of the business might be, compared with estimating the price at which a non-arbitrage security will sell in near-term markets.Martin J. Whitman,

A Hypothetical Example of a Costly Stop Loss

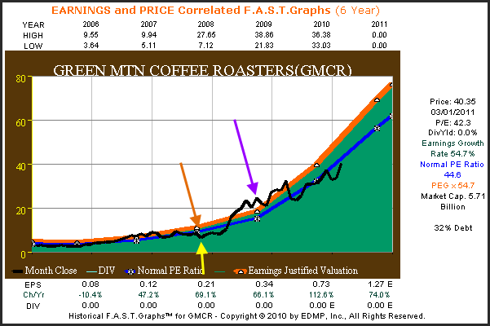

Let’s assume you intelligently bought Green Mountain Coffee Roasters (GMCR) on September 30, 2008 at $8.74 per share (orange arrow). Since this is a very fast-growing company, its PE ratio at the time was approximately 44.6, which is admittedly high. But, because its earnings growth rate was just under 55% per annum, it was trading at a PEG ratio below one, which many consider an attractive valuation. Nevertheless, the high absolute PE ratio motivated you to place a stop loss 15% below its $8.74 purchase price.

Therefore, by October 31, 2008, approximately one month later, Green Mountain Coffee Roasters’ stock price had fallen to $6.44. Consequently, you would have previously been stopped out of the stock because its price fell below the approximately $7.50 trigger price of your stop loss order (yellow arrow). But most importantly of all, notice how earnings-per-share had continued to grow at a very high rate, in spite of the short-term drop in stock price (the orange earnings justified valuation line continued to rise). In other words, fundamentals remained strong even though stock price had temporarily fallen.

Exactly one year later, after you had originally made a sound purchase of Green Mountain Coffee Roasters (GMCR) at $8.74 (the black stock price line was below the orange earnings justified valuation line), Green Mountain Coffee Roasters (GMCR) is trading at $24.61 (purple arrow) or almost 3 times your original purchase price. But alas, because you didn’t trust the principles of sound valuation you placed a stop loss order and were completely out of the position.

Clearly, the better long-term decision would have been to buy more of this terrific company on sale. Since you applied sound principles of valuation on your original purchase, and since fundamentals continued to grow stronger, you should have been a motivated buyer not seller. This is what we mean when we say that stop loss orders are for losers not winners. In this example, Green Mountain Coffee Roasters (GMCR) meets our definition of a winner. In our next examples we will look at losers as we defined them above.

click to enlarge images

Hypothetical Example of an Appropriate Stop Loss Strategy

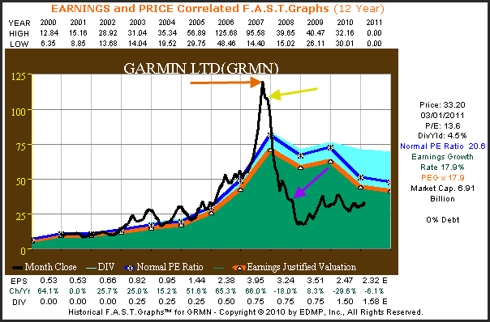

In this example, let’s assume that you were following Garmin Corporation (GRMN) back in calendar year 2007 when GPS technology was hot. You had watched the stock price rise from approximately $50 per share at the beginning of the year to over $119 per share by the end of September, and simply couldn’t stand being out of it anymore. The PE ratio at that time was approximately 30, but since growth was strong this didn’t scare you much and you bought the stock (orange arrow). However, because the stock had such a huge run over the short run, you placed a stop loss order 10% below your original purchase price.

Once again, within a month the stock price fell and triggered your stop loss (yellow arrow). However, in this example the stop loss makes sense because at such a high valuation, Garmin Corporation (GRMN) met our definition of a loser on both counts. Not only was the company significantly overvalued at the time of purchase (the black price line was significantly above the orange earnings justified valuation line), its fundamentals were also beginning to permanently deteriorate (the orange earnings justified valuation line falls). Consequently, approximately one year later on September 30, 2008, the stock you originally purchased at $119.40 a share would only be worth $33.94 a share (purple arrow). As our title stated, stop losses are for losers.

Summary and Conclusions

This article was written in order to illustrate a very basic difference between investing and trading (speculating). Traders (speculators) focus on stock price movement, and let price movement (volatility), dictate their buying or selling behavior. Investors on the other hand, focus on the business and the fundamentals behind the business. Investors base their decisions on the principles of business, economics and accounting. But most importantly, traders typically take a short-term position, while investors are in it for the long haul (at least a business cycle; 3 – 5 years).

If you view yourself as a trader of stocks, then market timing techniques like stop losses and even shorting strategies might make a lot of sense. However, if you see yourself as a prudent investor, then these techniques and others like them should be avoided. Instead, as a true investor you should take the lead of legendary investors like Marty Whitman, Warren Buffett , etc., and learn how to value a business. The goal is not to attempt to make perfect decisions; the goal is to attempt to make sound decisions.

In order to make our points, the examples illustrated in this article were obviously carefully chosen and extreme. However, there are literally thousands of other examples, some as extreme and others not as extreme, which could have been presented. Nevertheless, we contend that the primary premises are valid. If an individual chooses to place a bet on an overvalued stock because of momentum, then it is arguably a good idea to place a stop loss.

On the other hand, if an excellent company is carefully chosen based on sound fundamental values, then a stop loss can represent a very costly long-term mistake. If careful and thorough analysis indicated that an excellent company was a sound purchase at $20 a share, and nothing changed except that the stock price fell to $15 a share, that should indicate a buy signal, not a sell signal. If you really like the company at the first price, then you should really love it at the lower value.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.