Dividend Yield – Attractive Valuation

On Wednesday, November 30, NetApp (NTAP) – formerly Network Appliance, reported earnings that beat analysts’ estimates. Nevertheless, the dividend paying company lowered guidance for next year and the stock fell almost 6% for the day. This prompted a Citi analyst to state that the stocks pull back was what “investors were looking for.”

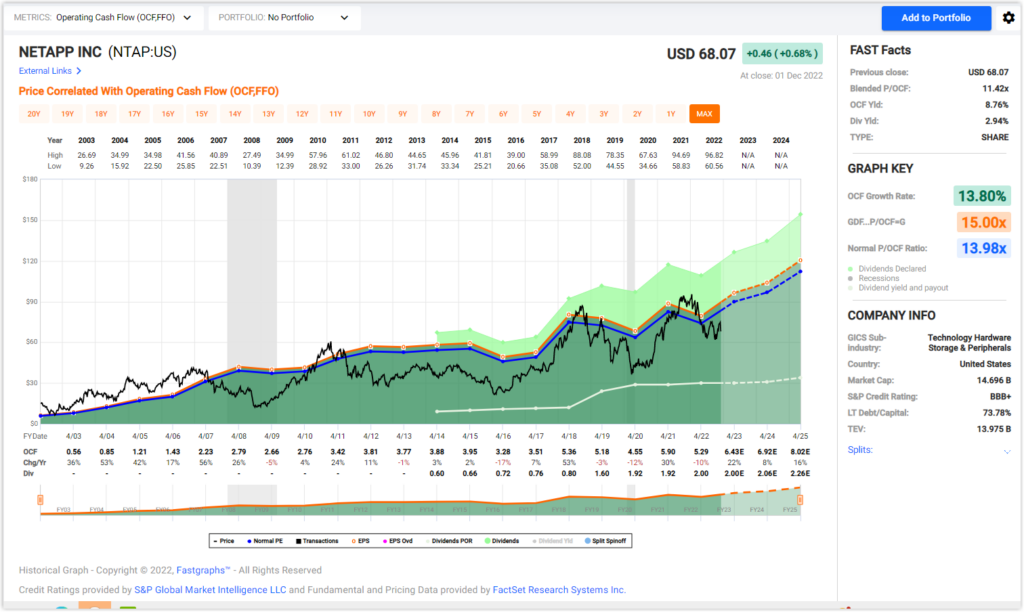

Consequently, I felt the stock was worth looking at since the current valuation looks extremely attractive. From a historical perspective the stock now trades at a very low P/E ratio offering a margin of safety and long-term growth potential. Therefore, the stock may appeal to investors looking for current income since it offers approximately a 3% dividend yield and reasonable growth going forward.

In this video I will run NetApp through the FAST Graphs’ looking glass as I examine future growth, dividend safety, and fiscal fitness.

FAST Graphs Analyze Out Loud Video on NetApp (NTAP)

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: No position.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.