Invest This Way – Proof That Value Investing Works

Why everyone should invest this way. With this video I have revisited previous videos going back as far as July 2017. The central idea is to illustrate how well valuation and value investing performs in the long run. This is true even when shorter-term performance based on a falling stock price tests the value investors’ mettle. The important point is that if fundamentals are doing well, holding up, and especially if they are growing, then stock price will inevitably follow – in the long run.

Value investing simultaneously reduces risk – long-term risk that is – and enhances total returns – once again long-term total returns. However, because of the fickle and unpredictable nature of short-term stock market action, value investing can appear to be failing but in truth it is performing beautifully. Investor psychology plays a major role. The experienced and accomplished value investor never let stock price movements ruin their confidence. Instead, their confidence is rooted in the realization that fundamentals matter, and that they matter a lot, and they matter much more than capricious short-term price movements. Stock prices lie whereas fundamentals speak the truth.

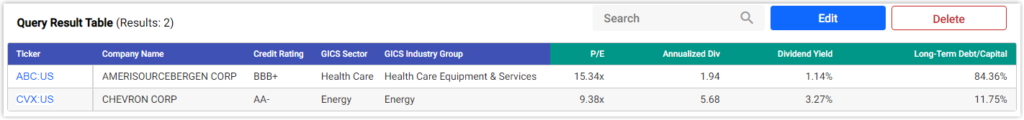

FAST Graphs Analyze Out Loud Video on AmerisourceBergen (ABC) and CVS (CVS)

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long CVS, ABC at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.