3M Introduction

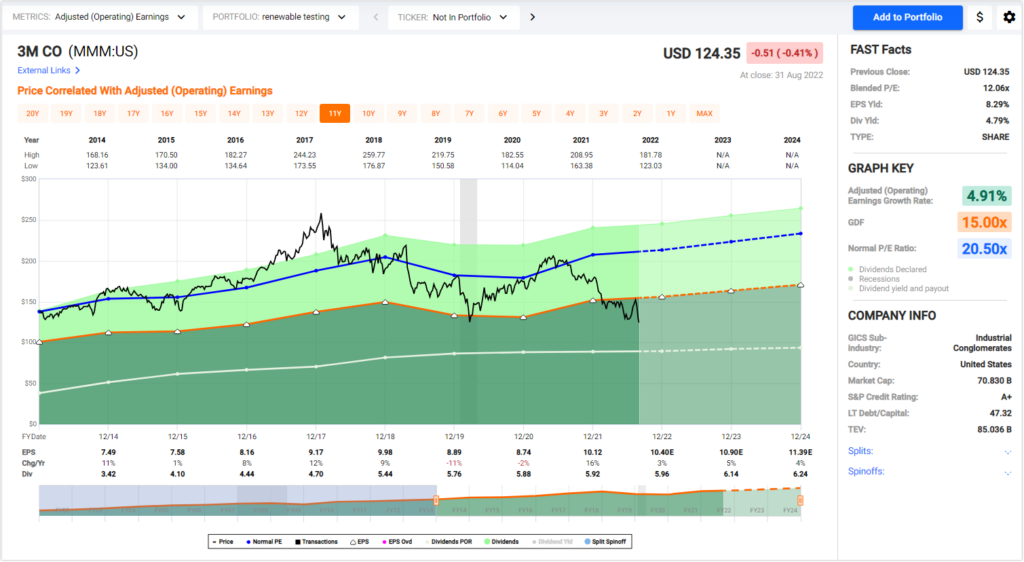

3M (MMM) is currently facing many challenges; however, I believe management is up to the challenges. The company is currently trading at one of the lowest valuations it historically has. Therefore, I do believe 3M offers a great long-term opportunity (and I emphasize long-term), but not without risk. In this video I will cover the good, the bad, and the ugly factors facing this A+ rated company.

3M’s current yield is 4.77% and seems safe given their ability to generate cash flow and a strong balance sheet. However, it is also possible that these things could change in the face of the losses confronting the company. On the other hand, many other high-quality companies have faced similar circumstances and not only survived but thrived. Johnson & Johnson with its Tylenol, baby powder litigations and even companies like Altria that faced many lawsuits of their own. These companies survived and continue to. I for one am betting that 3M will follow suit. Nevertheless, there is no substitute for comprehensive and I might add continuous research and due diligence. But I do want to preface that last statement by pointing out that I am not concerned about what the price does, I am concerned with what happens to the fundamentals over the long-term.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long MMM at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.