Dividend Growth Stocks

The “holy grail” of value investing is the only important “margin of safety.” A margin of safety is present if you invest in a common stock at a discount to its intrinsic value. This powerful concept simultaneously reduces risk while providing a greater potential for above-average return. Risk is reduced because you are buying the company for less than it is worth or justified based on its earnings and cash flows. Consequently, if you hit a bear market, your undervalued stocks might fall along with the overvalued ones. However, history has shown that the undervalued stocks will typically recover fastest and typically exceed their previous values. Overvalued stocks in contrast might never reach the high valuations they had achieved before the correction. With this video I feature 5 premier dividend growth stocks each offering a margin of safety and yields above 3%. Moreover, they all have a history of increasing their dividends at above-average rates over time as well. Therefore, they represent ideal research candidates for the dividend growth investor seeking safety, yield, and the potential for capital appreciation over time.

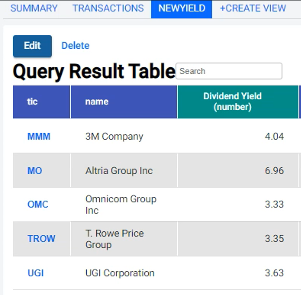

3M Company (MMM), Altria Group (MO), Omnicom Group (OMC), T. Rowe Price Group (TROW), UGI Corporation (UGI)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long MMM, MO, OMC, TROW, UGI at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.