Global Payments Inc (GPN)

Renowned investor Peter Lynch gave us a formula that when a stock’s P/E ratio was equal to its earnings growth rate it was fairly priced. However, it is important to recognize that Peter Lynch was a growth investor and that he was looking for significantly above average growth. In the same context, I consider the P/E ratio equal to earnings growth rate a very relevant formula for valuing stocks to grow at 15% a year or better. When you can identify a fast-growing company selling at a P/E ratio below its growth rate, you’ve identified what is often referred to as a GARP or growth at a reasonable price opportunity.

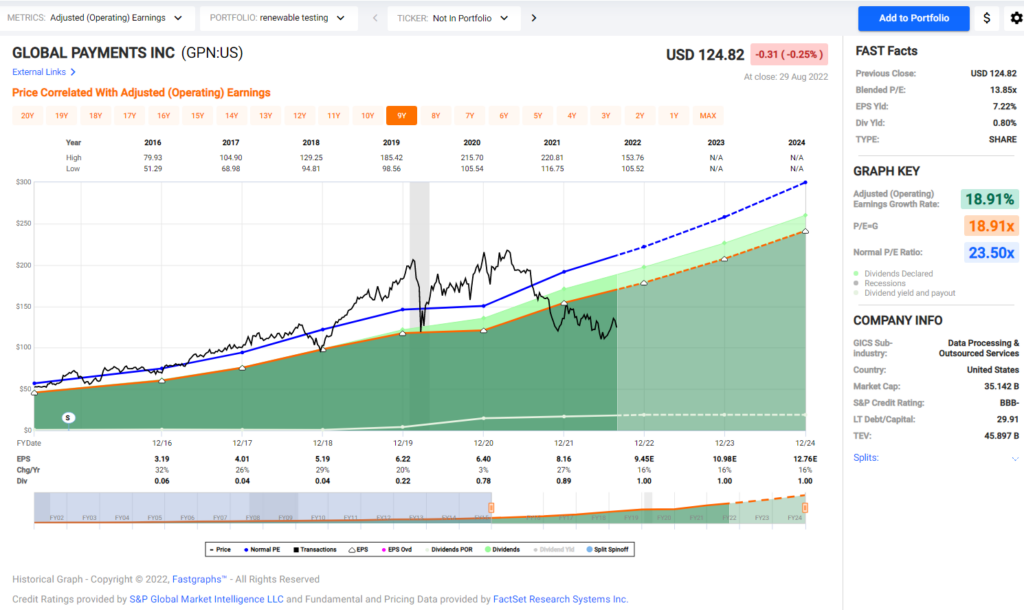

Global Payments Inc. is a leading payment processing company in the data processing and outsourced services sub-industry sector. The company’s historical earnings growth rate has averaged just under 18% and the company can be bought at a blended P/E ratio of 13.85. Thus, by definition, defines Global Payments Inc. as a growth stock at a reasonable price. In this analyze out loud video, Mr. Valuation will go through the important metrics on this fast-growing payment processor by the numbers.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long GPN at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.