Introduction

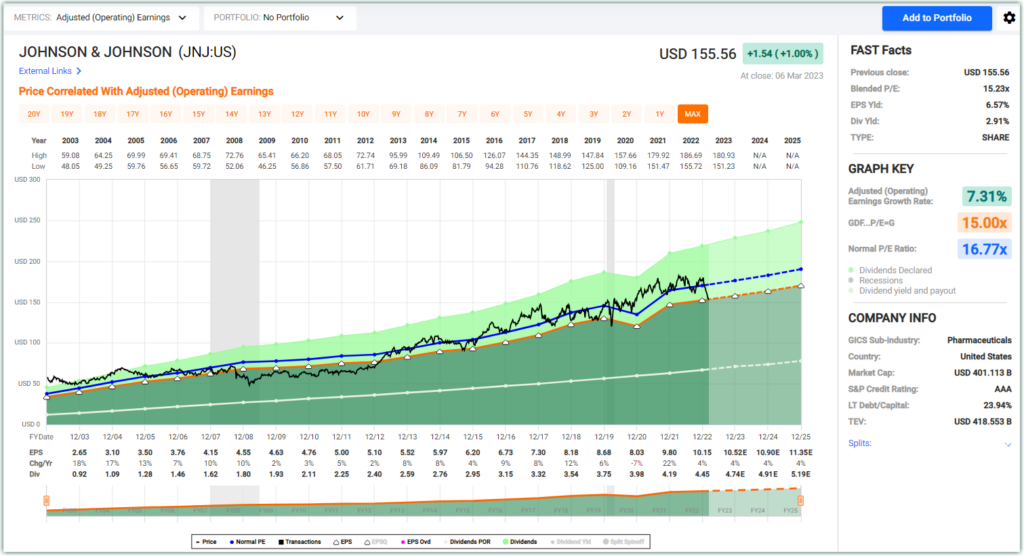

Johnson & Johnson’s (JNJ) stock price has fallen approximately 13% since the beginning of the year. However, operating earnings are expected to increase modestly while operating cash flow is expected to increase 45% or more after dropping 1% in 2020 and 9% in 2022. Nevertheless, JNJ’s dividend is well covered and the company’s balance sheet contains enough cash and short-term investments to cover any contingent liabilities from several lawsuits on talcum powder and opioids.

From a valuation perspective, JNJ has fallen into fair value territory, but we do not consider it dramatically undervalued. Consequently, for those investors who are looking for high quality, and above-average dividend yield approaching 3%, JNJ may be just the ticket. The point is that the future return is expected to be positive but single digit. Considering the quality of this AAA rated behemoth with a strong balance sheet, it could be attractive to many types of investors. We consider JNJ a solid hold and a reasonably valued buy at this time. In order to receive a true margin of safety, Johnson & Johnson would have to fall further from here which may or may not occur. Caveat emptor.

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long JNJ

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.