Information Technology Sector

In this video, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation, will discuss the concept of value investing in the information technology sector. He will explain how to identify stocks that are trading at reasonable values. He will also highlight the importance of buying stocks at fair value and the consequences of paying high valuations. Throughout the video, Chuck will provide examples of companies that look attractively valued in each sector.

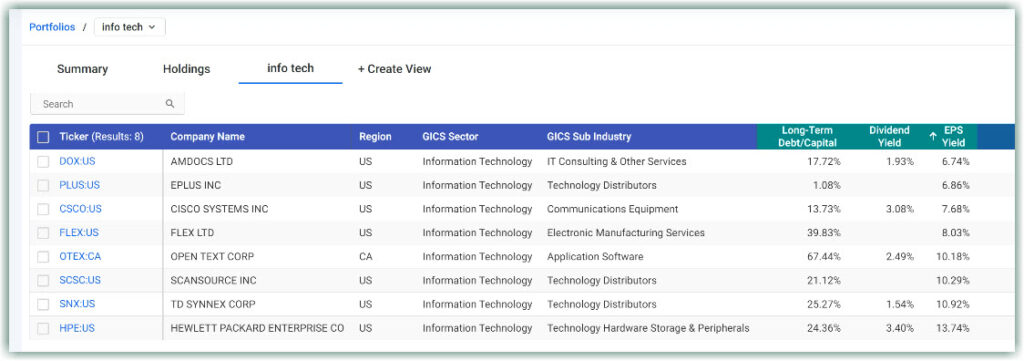

The information technology sector offers an awful lot of growth. On the other hand, value is hard to come by. Enjoy the video!

In this video Chuck Carnevale will cover Cisco Systems (CSCO), Amdocs Ltd (DOX), Flex Ltd (FLEX), Hewlett Packard Enterprise (HPE), Open Text Corp (OTEX:CA), Eplus Inc (PLUS), Scansource Inc (SCSC), TD Synnex Corp (SNX), Apple (AAPL), Adobe Inc (ADBE), Microsoft Corp (MSFT), Servicenow Inc (NOW), Nvidia Corp (NVDA)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long CSCO, HPE, OTEX:CA, NVDA

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.