Beat the Overvalued S&P 500 – Reviewing Model Portfolio 1 from Aug 20, 2021

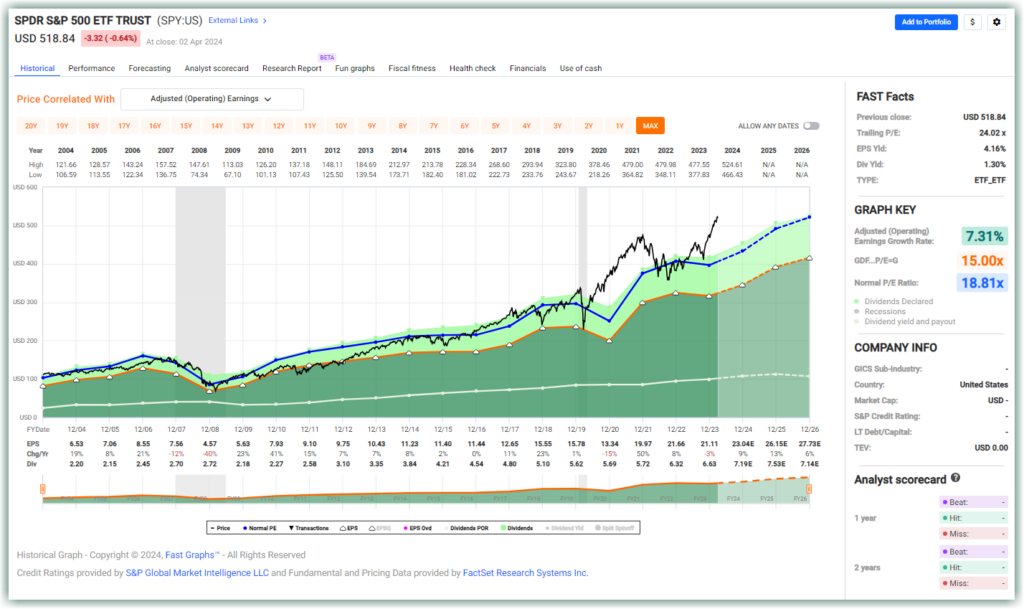

In this video Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation is going to share a surefire method or strategy to beat the overvalued S&P 500 in both a total income basis as well as a total return basis.

Chuck is going to re-visit a set of videos that he produced in August of 2021 where he created three model portfolios. He created an income portfolio, equal weighted dividend income portfolio based on fairly value dividend growth stocks, and then he created one that had more growth oriented into it for both growth of income and growth of dividends, and then finally another strategy of where he overweight several of the stocks in the portfolio so that he could generate greater income and still provide good results.

In this video, Chuck will go over Abbvie (ABBV), Amgen Inc (AMGN), Franklin Resources (BEN), Cardinal Health (CAH), Chemours Co (CC), Eastman Chemical (EMN), Enterprise Products Partners (EPD), HP Inc (HPQ), Ingredion (INGR), JP Morgan Chase (JPM), Altria Group (MO), UGI Corp (UGI)

FAST Graphs Analyze Out Loud Video

Try FAST Graphs for FREE Today!

SUBSCRIBE to our YouTube Channel

Click here for our Research Articles

Disclosure: Long ABBV, AMGN, CAH, CC, EMN, EPD, HPQ, INGR, JPM, MO, UGI

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.